Tax, like gravity, is an inescapable fact of life. Whether you are in a salaried position, director of a company, a self-employed sole trader, or any other job, you will have to pay tax in one form or another.

If you are old enough to work, you probably already have a good handle on what tax is, but it is technically defined as:

A compulsory contribution to state revenue, levied by the government on workers’ income and business profits, or added to the cost of some goods, services, and transactions.

Oxford Dictionary

Put simply, it’s one of your ways of contributing to the costs of running the country – taking care of some of its infrastructure, public services, and keeping it safe. If you’re looking to learn more about tax as a musician, you may also want to check out our blog on VAT for bands.

For musicians and those working in the music industry, the vast majority of us will not be in a salaried job.

Although it was carried out back in 2012, the Musicians’ Union survey The Working Musician found that:

Only 10% of musicians are full-time salaried employees. Half of musicians have no regular employment whatsoever. The vast majority of musicians (94%) work freelance for all or part of their income.

The MU

For anyone working in the industry, It’s hard to imagine those figures will have changed much since the study was carried out.

However, there are exceptions to the rule – many orchestral musicians will be on a salary. In-house sound technicians may be salaried by a venue, and specific cruise ship musicians will also be paid a monthly salary.

But, by and large, if you are a performer, recording artist, session musician or anything similar, you will be self-employed (usually a sole trader).

Who should register as self-employed?

Musicians can generally be sorted out into one of three categories:

- Music is a hobby or interest and is it’s own reward. It is done purely for the love of doing it.

- You have a salaried (or other) job that provides the majority of your income, but you supplement this with gigging or other another musical activity that earns you money.

- You are a full-time musician, by trade. The majority of your income comes from your role in the music industry.

Of course, the lines have a tendency to blur. However, the central point is that, if you fall into categories 2 or 3, you should be paying tax on your earnings, and should really consider registering as self-employed as soon as possible.

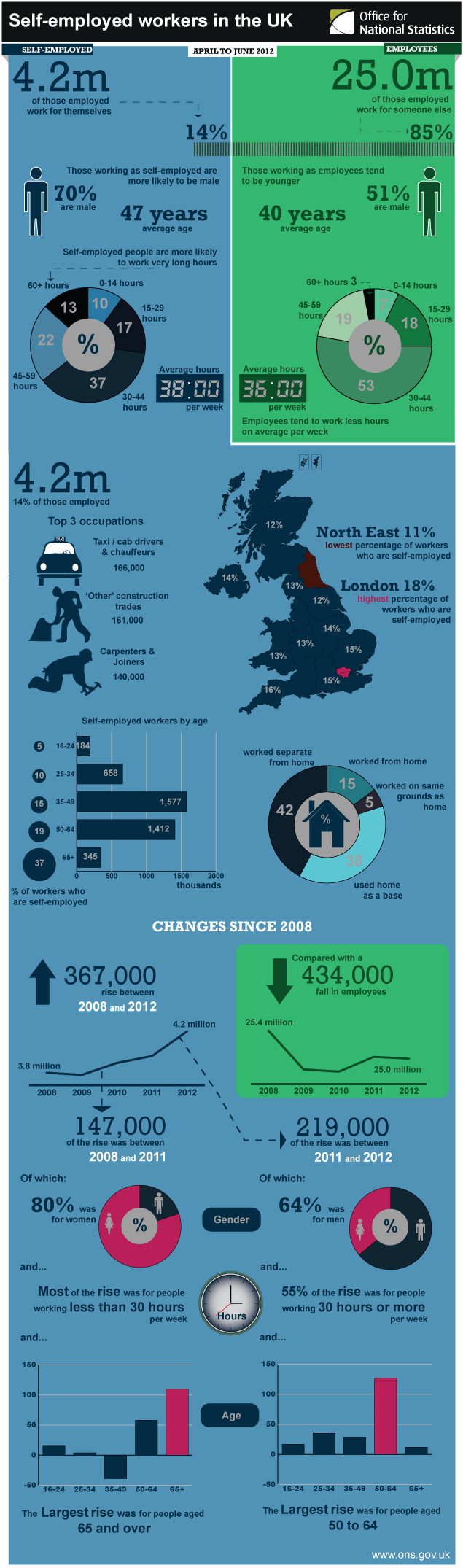

Infographic by Office for National Statistics (ONS)

How does being self-employed work?

At its simplest, being self-employed means that you are responsible for your own tax affairs.

Once a year, you (or your accountant) will need to complete a tax return for the previous tax year, detailing how much you have earned and have many expenses you have incurred. You will then be told how much tax you owe.

You will be notified by letter when it is time to complete your return and can then submit it at any point up to 31st October (or January 31st for those completing online) but do keep in mind that you will also have to pay your tax bill by 31st of January (whether filed by paper or online) so the sooner you complete your return, the sooner you can make provision for the amount of tax you owe.

There can be financial penalties if you send in your tax return late (usually a £100 fine) without a valid reason.

The good news is that any legitimate expenses associated with your career can be written off your tax bill – this can cover anything from your bass strings, brand new Gibson guitar or that research trip to Rio De Janeiro (an absolute necessity).

If you also receive a salary, there are implications for your self-employed tax return which are best discussed with a tax professional.

What actually constitutes a business expense is a little bit of a grey area, so you should always keep the receipt of purchase and be ready to genuinely articulate a reason for why the purchase was needed for your business.

There are all sorts of other expenses that include claiming petrol, travel expenses and even household bills if you use your home as your office – but these are best researched or discussed with an accountant or tax professional.

The Musicians’ Union also has advice specifically relating to legitimate expenses.

Why be self-employed and how to register

The first reason for being self-employed is pretty simple. Technically, if you are earning money that you aren’t paying tax on, you are breaking the law.

In order to make the most of your musical career, you’ll need to get the fundamental legitimacy that being self-employed involves, such as invoicing for payment.

There are also several banking and insurance incentives, as well as support schemes that self-employed sole traders can take advantage of.

Setting yourself up as self-employed is relatively easy. You will need to create a Government Gateway account and register with HMRC for your unique tax code – please see the gov.uk guidelines.

Some banks will also require you to have a separate business banking account (there will sometimes be charges associated with this).

It’s worth remembering that, as a musician, you will occasionally be paid in cash. If you use business banking, there may be charges for depositing cash and cheques.

It is also worth noting that you will have to declare cash that you earn as well as payments into your bank account. Irregularities in your tax returns can lead to you being investigated by HMRC.

National Insurance

- If you are making a profit of over £6,515 a year, you will be liable to pay National Insurance (NI) contributions. Paying NI helps you contribute towards state benefits, and means you can claim things like the state pension.

- The Gov.UK website lists precisely what you are paying towards.

- Being self-employed, you will be liable to pay class 2 NI contributions.

- You’ll pay NI at the same time that you file your tax return.

Please remember: this article is designed to be helpful with some of the basics, but if you have any problems or queries regarding tax, you should consult with an accountant, tax professional or HM Revenue and Customs.

Need to generate an invoice to get paid?

Check out this free invoice generator and templates for musicians and bands.

Do have any top tips or advice for managing taxes and keeping on top of paperwork? Leave them in the comments below…

Share this: